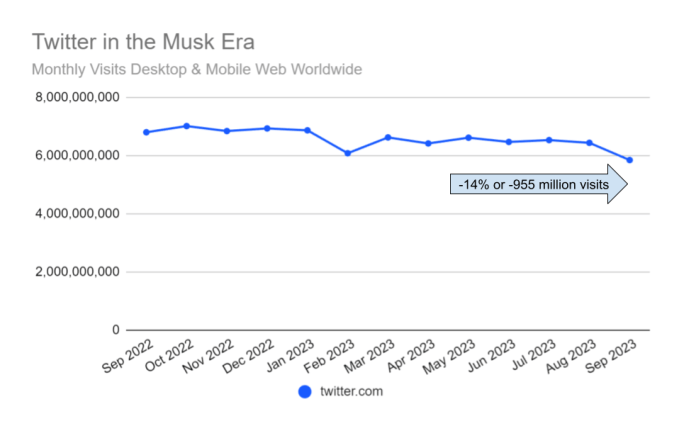

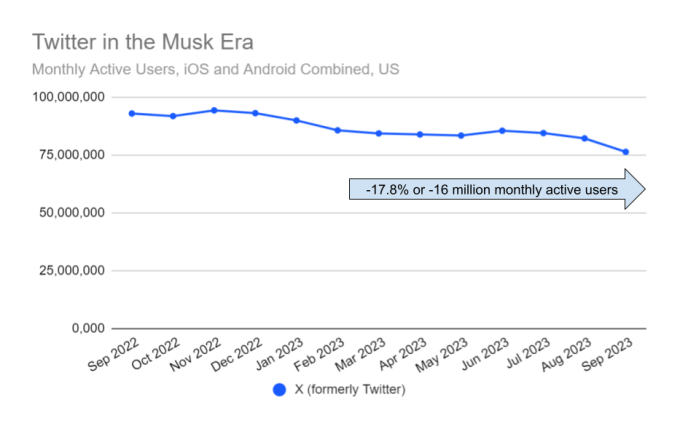

Despite proclamations from X CEO Linda Yaccarino that usage of the social network was at an all-time high this summer, a new report is throwing cold water on those claims, saying that X usage has actually declined on all fronts, across both web and mobile. According to data from market intelligence firm Similarweb, X’s global website traffic was down 14% year-over-year in September, and U.S. traffic was down by 19%. On mobile devices in the U.S., performance had also declined 17.8% year-over-year, based on monthly active users on iOS and Android.

Image Credits: Similarweb

Although the U.S. accounts for roughly a quarter of X’s web traffic, other countries also saw declines in web traffic, including the U.K. (-11.6%), France (-13.4%), Germany (-17.9%) and Australia (-17.5%).

The report notes that September was not just a fluke, either, as declines in usage were visible in long-term trends as well. When comparing the first nine months of 2023 with the same period in 2022, Simiarweb found X’s website traffic was down 11.6% year-over-year in the U.S. and down by 7% worldwide. Mobile app usage in the U.S. was also down by 12.8% during that same period of time.

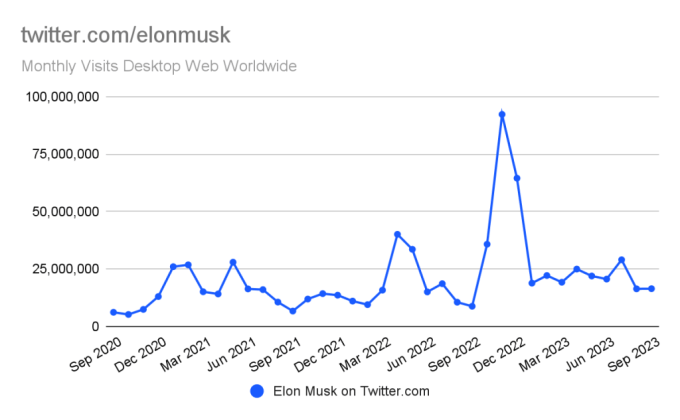

However, there is one bright spot for X…or rather its owner, Elon Musk. Traffic to Musk’s profile page on the site was up 96% year-over-year as of last month.

Image Credits: Similarweb

The firm’s estimates are determined by machine learning algorithms powered by millions of websites and apps’ first-party analytics, including through its own consumer products that measure device traffic data as well as through partnerships with other companies, including ISPs, other measurement firms and demand-side platforms. Its methodology on mobile devices relies heavily on Android data, however, because of the tighter restrictions Apple places on its App Store and data privacy.

Still, even with a glimpse into Android data, you can get a sense of how well X is faring. On that front, Similarweb notes that X mobile app usage worldwide was down by 14.8% on Android, compared with the -17.8% drop in the U.S. across iOS and Android.

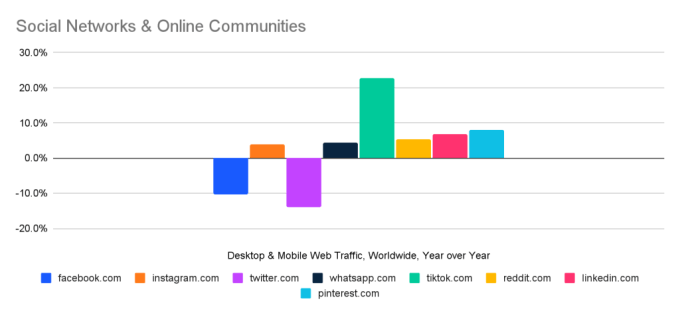

The report also indicates that X’s declines are part of a broader shift, as web traffic to the top 100 social networks and online communities the firm tracks were also down by 3.7% in September, save TikTok, which grew 22.8% on a global basis. Facebook web traffic, for example, was down 10.4%.

Image Credits: Similarweb

Image Credits: Similarweb

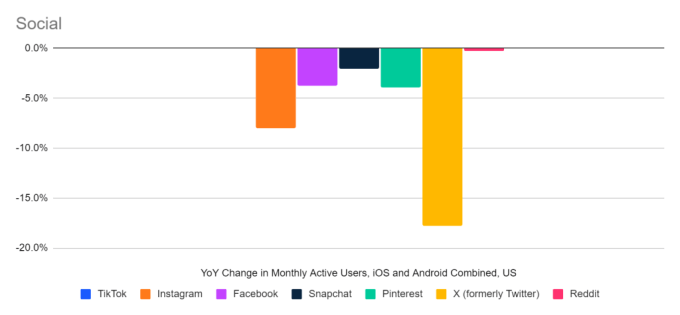

On mobile, the same trend was true, but X’s monthly active users declined by 17.8% in September, compared with Facebook and Instagram, down by 8% and 3.7%, respectively.

Image Credits: Similarweb

In addition, Similarweb’s analysis touches on the declining importance of X in the news ecosystem, noting that three years ago, The New York Times would receive 3-4% of its traffic from Twitter, but that’s now down to less than 1%. Of course, X began throttling links to the Times in August, along with other competitors like Bluesky and Threads. This week, X was accused of throttling Patreon links as well.

But in reality, Twitter’s importance to news publishers has always been overstated. News may have broken on Twitter but it was never a significant traffic source. In fact, NPR left the platform six months ago after Musk began labeling it and other outlets as “state-affiliated media.” A recent report from Nieman indicates NPR’s loss of traffic from leaving X has been “negligible” — traffic only dropped by a single percentage point, where it used to account for just under 2% of overall traffic.

Though the report doesn’t include much good news for X, it did admit that the app seems to have staying power.

“…somehow the X / Twitter audience has eroded but not evaporated,” wrote Similarweb’s Senior Insights Manager David Carr.

That’s worth noting, given the increased competition from new competitors like Bluesky, Post, Pebble, Spill, Mastodon and Threads.

X would likely dispute Similarweb’s findings, as its execs have only touted traffic increases, not declines. The company recently told TechCrunch that X sees 500 million posts per day, including original content, replies and reposts, and noted that X generates 100 billion impressions per day. Yaccarino also shared other figures at an event in October, noting that people are spending 14% more time on X, with a 20% increase in consuming video, and that 1.5 million sign up for X daily, up 4% year-over-year.

X did not respond to requests for comment.